WHAT IS DUAL PRICING

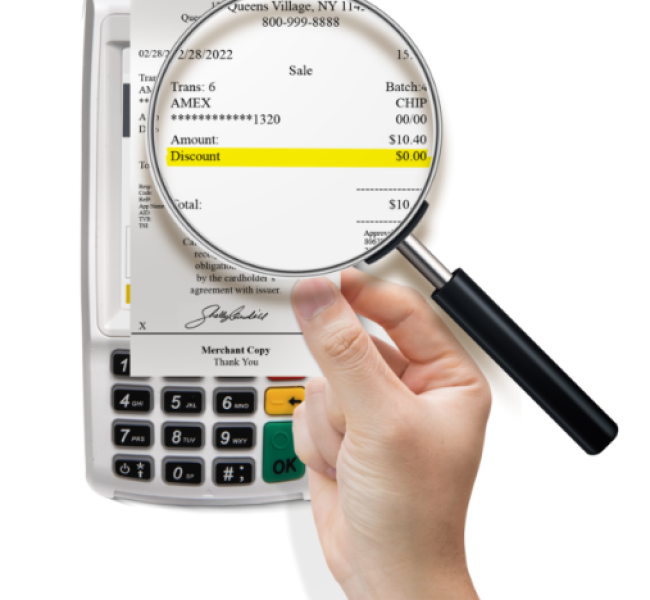

With the help of the Makkah Merchant Processing Dual Pricing initiative, Swipe4Free, shop owners can give clients who choose to pay with cash or a card two alternative transaction amounts. The customer may easily see the difference between the two costs on the PIN pad and terminal, as well as the discount that is applied when paying with cash. Customers who purchase with cash usually receive a 4% discount.

Unique Aspects of Dual Pricing

01

02

03

- Both the Point-of-Sale and the entrance need to have signage.

Precise sum or proportion of the surcharge.

Declaration that the business is imposing a surcharge.

Only credit card transactions are subject to a surcharge.

The surcharge does not exceed the MDR.

Signage needs to specify. - Before processing, the merchant needs to register with Mastercard. This takes 30 days.

- The merchant is required to complete the Merchant Attestation in addition to the merchant application.